Can Life Coaching Help Me Get Out of Debt?

Debt can feel overwhelming, but life coaching offers a personalized and supportive approach to help you tackle it step by step. A life coach focuses not just on numbers, but on the mindset and habits that contribute to debt. Here’s how a life coach can help you take control of your debt and build healthier financial habits to get out of it for good.

Changing Your Money Mindset

Before diving into the practical side of debt repayment, a life coach will first help you examine your beliefs and mindset around money. Many people have unconscious habits or emotions that lead to accumulating debt.

- Explore Emotional Spending Triggers: Identify the emotions that drive impulsive purchases or overspending, such as stress, boredom, or guilt.

- Shift Your Perspective on Debt: Learn to view debt not as a failure but as a challenge that you can overcome with the right mindset.

- Set Positive Money Affirmations: Create positive affirmations that can help reshape how you think about money and debt, making it easier to stay focused on repayment.

Creating a Customized Debt Repayment Plan

Once you’ve addressed your money mindset, the next step is developing a practical, customized debt repayment plan. A life coach will help you prioritize your debts and create a strategy that fits your lifestyle.

- List All Debts: Start by documenting all your debts, including amounts, interest rates, and minimum payments.

- Identify Your Debt Strategy: Depending on your situation, you may use methods like the debt avalanche (paying high-interest debts first) or debt snowball (paying small balances first) to stay motivated.

- Plan for Extra Payments: Find opportunities to make extra payments without drastically changing your lifestyle, such as redirecting small savings from cutting back on discretionary spending.

Building Accountability and Consistency

Accountability is key when it comes to sticking with a debt repayment plan. A life coach serves as a partner in your debt-free journey, helping you stay committed to your goals.

- Regular Check-Ins: Schedule regular sessions with your life coach to review your debt progress and celebrate small wins.

- Set Deadlines for Payment Milestones: Establish specific deadlines for paying off certain amounts or types of debt, which your coach will help you stay accountable for.

- Create a Visual Tracker: Work with your life coach to create a visual representation of your debt-repayment journey (e.g., a chart or graph) to keep you motivated.

Check out the Vision to Action Planner for only 6$

More infoIdentifying Spending Leaks

One of the most effective ways to get out of debt is to reduce unnecessary spending. A life coach will help you uncover where your money is going and identify areas where you can cut back.

- Track Your Spending: Analyze your daily, weekly, and monthly spending to find patterns and identify areas where you’re overspending.

- Set Small Spending Challenges: Challenge yourself to reduce spending in certain categories (e.g., groceries or entertainment) each month with guidance from your life coach.

- Eliminate Impulse Buys: Work on strategies to resist impulse purchases, such as implementing a 24-hour rule before buying non-essential items.

Cultivating Financial Discipline

Debt repayment requires discipline, which can be tough when you’re balancing other life demands. A life coach helps you build the discipline needed to stick to your plan.

- Create Reward Systems: Instead of treating yourself with money, set up non-financial rewards when you hit certain debt milestones (e.g., a day off, a hobby, or a nature trip).

- Focus on Daily Habits: Practice small, daily habits that support your goal, like checking your account balances or reviewing your budget every morning.

- Break Down Big Payments: Break larger payments into smaller, manageable amounts to make the process less intimidating and help you avoid missing due dates.

Quiz: What Is Blocking Your Success?

This quick quiz will help you figure out which mental or behavioral pattern might be holding you back from achieving your full potential. Identifying your specific success blocker is the first step toward breaking through to new levels of achievement and fulfillment.

Read each question and choose the answer that feels most true to your situation.

No email or payment is required to complete the quiz and receive your personalized insights.

Once you have your primary success blocker, you have clarity about what’s been holding you back. This awareness is powerful—many people spend years struggling without understanding the specific pattern that’s limiting their progress.

Remember, these patterns aren’t permanent character traits but rather habitual ways of thinking and behaving that can be changed with the right guidance and practice.

If you’re ready to break through your specific blocker and achieve the success you know you’re capable of, send me an email to try out a coaching session. Your breakthrough awaits!

Developing Long-Term Financial Habits

Getting out of debt isn’t just about paying off balances—it’s about making long-term changes to ensure you don’t end up in debt again. Life coaches emphasize lasting financial habits that will keep you debt-free.

- Build a Cushion for Unexpected Expenses: Start setting aside small amounts for emergencies, so you don’t rely on credit in times of crisis.

- Adjust Your Budget Monthly: Work with your coach to review and adjust your budget each month based on changes in your income or expenses.

- Practice Mindful Spending: Cultivate awareness around spending by asking yourself if a purchase truly aligns with your financial goals.

Reducing Financial Stress

Debt can be a huge source of stress, and overcoming it isn’t just about finances—it’s also about mental well-being. A life coach helps you manage the emotional burden of debt.

- Use Mindfulness Techniques: Incorporate mindfulness practices to help reduce anxiety related to debt, such as deep breathing or journaling.

- Break Debt into Manageable Goals: Instead of focusing on the total amount of debt, focus on smaller, achievable goals to reduce overwhelm.

- Create a Support System: Your life coach will help you identify friends, family, or communities that can support your debt-free journey, offering encouragement and advice.

Life coaching can play a pivotal role in helping you get out of debt by addressing both the practical and emotional aspects of debt repayment. Through personalized strategies, accountability, and long-term habit-building, a life coach guides you through the process of becoming debt-free and ensures you stay on track to avoid future debt. By focusing on mindset shifts and sustainable habits, life coaching can transform how you manage your finances for the better.

Still waiting for the 'perfect time'?

Email me what you'd do if you stopped making excuses. We'll work backwards from there.

Let's startRecent posts

-

The Complete Guide to Becoming a High Achiever

Read blog -

How To Make a Positive Impact in Your Community

Read blog -

What Is the “Winter Arc” Challenge?

Read blog -

What Is "the Great Lock-In" and Should You Try It?

Read blog -

What Are the 75 Hard and Soft Challenges?

Read blog -

How to Validate Yourself

Read blog

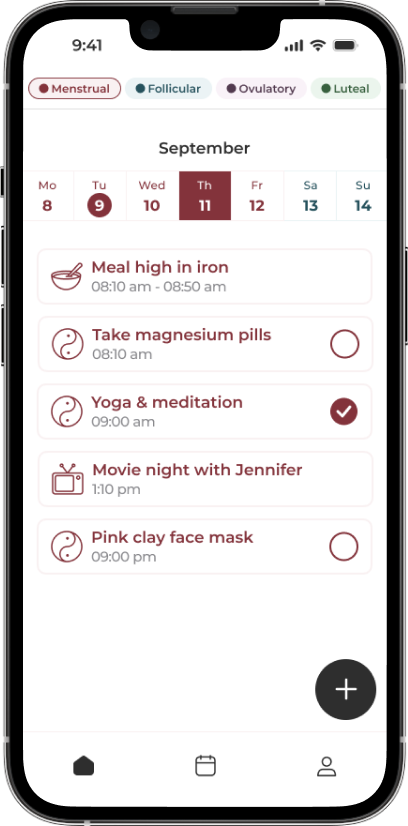

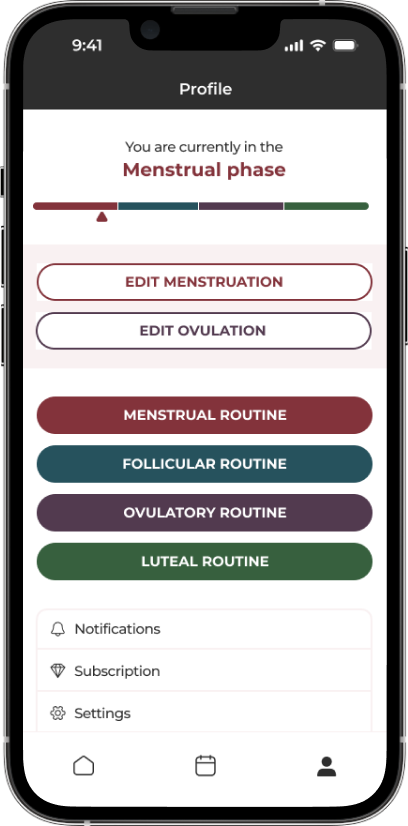

The App Made To Sync Your Lifestyle to Your Menstrual Cycle.

A solution for women who are looking to keep track of what they sync to their cycles, such as fitness, diet, etc. by adding it to a calendar that also predict their phases.

Learn more

Comment