How Can a Life Coach Help Me Create a Financial Plan?

Creating a financial plan can feel overwhelming, especially if you’re unsure where to start or how to navigate your financial goals. A life coach can provide valuable support in developing a personalized financial plan that aligns with your aspirations. Here’s how a life coach can help you step by step.

Understanding Your Current Financial Situation

The first step in creating a financial plan is gaining a clear understanding of your current financial situation. A life coach will help you gather and analyze your financial data, including income, expenses, debts, and savings.

- List Your Income: Document all sources of income, including salaries, freelance work, and passive income.

- Track Your Expenses: Categorize your monthly expenses (fixed, variable, and discretionary) to see where your money goes.

- Assess Your Debt: Make a list of all debts, including balances, interest rates, and payment schedules.

Identifying Your Financial Goals

Once you have a clear picture of your finances, your life coach will help you identify your short-term and long-term financial goals. These goals will serve as the foundation for your financial plan.

- Define Short-Term Goals: These might include saving for a vacation, paying off a credit card, or building an emergency fund.

- Set Long-Term Goals: Consider goals like buying a home, saving for retirement, or funding your children’s education.

- Make Goals SMART: Ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound.

Creating a Budget

A budget is a crucial component of any financial plan. A life coach will guide you in creating a budget that aligns with your financial goals and allows for flexibility.

- Choose a Budgeting Method: Decide between methods like zero-based budgeting, the 50/30/20 rule, or envelope budgeting, based on what suits you best.

- Allocate Funds: Distribute your income across essential expenses, savings, and discretionary spending according to your chosen budgeting method.

- Track and Adjust: Regularly monitor your budget and make adjustments as necessary to stay on track.

Check out the Vision to Action Planner for only 6$

More infoDeveloping a Savings Strategy

Building savings is essential for achieving your financial goals. A life coach can help you create a savings strategy that works for your lifestyle.

- Establish an Emergency Fund: Aim to save three to six months’ worth of living expenses to cover unexpected costs.

- Set Up Savings Goals: Create specific savings goals for your short-term and long-term objectives.

- Automate Savings: Set up automatic transfers to your savings accounts to ensure consistency and discipline.

Managing Debt

Managing and reducing debt is often a priority in financial planning. A life coach can assist you in developing strategies to tackle your debts effectively.

- Prioritize Your Debts: Use methods like the avalanche (highest interest first) or snowball (smallest balance first) strategies to pay down debt.

- Create a Payment Plan: Establish a timeline for paying off each debt based on your prioritized strategy.

- Explore Consolidation Options: Discuss options for consolidating high-interest debts into lower-interest loans, if applicable.

Investing for the Future

Investing is crucial for building wealth over time. A life coach can guide you in understanding investment options and developing a plan that aligns with your risk tolerance and goals.

- Assess Your Risk Tolerance: Discuss your comfort level with risk and how it affects your investment choices.

- Explore Investment Options: Learn about different investment vehicles such as stocks, bonds, mutual funds, and real estate.

- Create an Investment Strategy: Develop a diversified investment plan that reflects your goals and risk tolerance.

Monitoring Progress and Making Adjustments

A financial plan is not a one-time effort; it requires regular review and adjustments. A life coach will help you monitor your progress and adapt your plan as needed.

- Set Regular Check-Ins: Schedule monthly or quarterly meetings to review your financial situation and progress toward your goals.

- Adjust Goals as Needed: Be open to adjusting your goals based on changes in your life circumstances or financial situation.

- Celebrate Milestones: Acknowledge and celebrate your progress to stay motivated.

Creating a financial plan can seem daunting, but a life coach can simplify the process and provide valuable guidance at every step. From understanding your current financial situation to setting goals and monitoring your progress, a life coach helps you build a plan tailored to your unique needs. With their support, you can take control of your finances and work toward achieving your financial aspirations.

Quiz: What Is Blocking Your Success?

This quick quiz will help you figure out which mental or behavioral pattern might be holding you back from achieving your full potential. Identifying your specific success blocker is the first step toward breaking through to new levels of achievement and fulfillment.

Read each question and choose the answer that feels most true to your situation.

No email or payment is required to complete the quiz and receive your personalized insights.

Once you have your primary success blocker, you have clarity about what’s been holding you back. This awareness is powerful—many people spend years struggling without understanding the specific pattern that’s limiting their progress.

Remember, these patterns aren’t permanent character traits but rather habitual ways of thinking and behaving that can be changed with the right guidance and practice.

If you’re ready to break through your specific blocker and achieve the success you know you’re capable of, send me an email to try out a coaching session. Your breakthrough awaits!

Still waiting for the 'perfect time'?

Email me what you'd do if you stopped making excuses. We'll work backwards from there.

Let's startRecent posts

-

The Complete Guide to Becoming a High Achiever

Read blog -

How To Make a Positive Impact in Your Community

Read blog -

What Is the “Winter Arc” Challenge?

Read blog -

What Is "the Great Lock-In" and Should You Try It?

Read blog -

What Are the 75 Hard and Soft Challenges?

Read blog -

How to Validate Yourself

Read blog

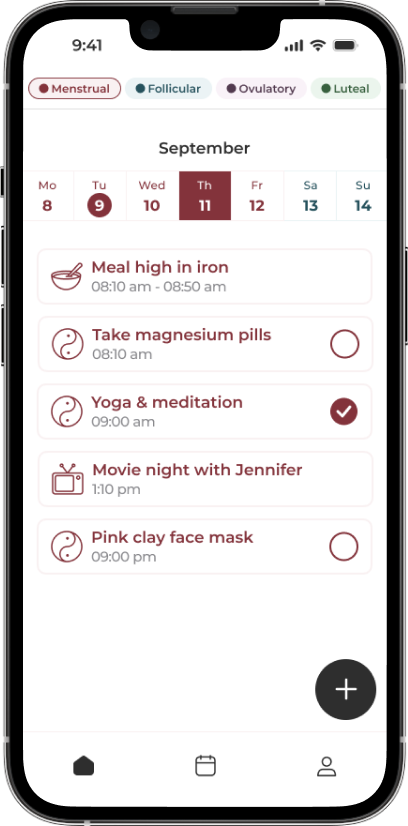

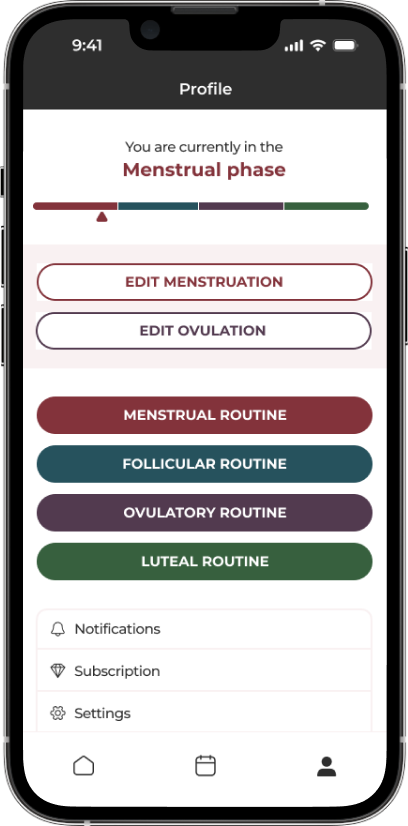

The App Made To Sync Your Lifestyle to Your Menstrual Cycle.

A solution for women who are looking to keep track of what they sync to their cycles, such as fitness, diet, etc. by adding it to a calendar that also predict their phases.

Learn more

Comment