How Can a Life Coach Help with Financial Anxiety?

Financial anxiety is a common issue that affects people of all backgrounds, often leading to stress, sleepless nights, and a constant worry about money. While traditional financial advisors focus on budgeting and investments, a life coach takes a more holistic approach, addressing the emotional and mental aspects of financial stress. If you’re struggling with financial anxiety, here’s how a life coach can help you regain control and find peace of mind.

Identifying the Root Causes of Financial Anxiety

Financial anxiety isn’t always about the numbers—it often stems from deeper emotional triggers like fear of instability, guilt over past financial decisions, or uncertainty about the future. A life coach helps you identify these underlying causes by asking the right questions and encouraging self-reflection. By understanding what’s really driving your financial worries, you can begin to tackle the problem from the inside out.

Setting Realistic Financial Goals

One of the ways a life coach helps is by guiding you to set realistic, achievable financial goals. Instead of feeling overwhelmed by debt or savings targets, a coach can help you break down your financial objectives into manageable steps. This not only makes the process less daunting but also gives you a sense of progress as you move closer to your goals, reducing anxiety over time.

Check out the Vision to Action Planner for only 6$

More infoShifting Your Mindset Around Money

For many, financial anxiety is linked to deeply ingrained beliefs about money, such as scarcity, fear of failure, or self-worth tied to financial success. A life coach can help you shift your mindset, turning negative beliefs into more positive, constructive ones. Through various exercises and discussions, you’ll learn how to view money not as a source of stress but as a tool to achieve your life goals. This mental shift can dramatically reduce your anxiety and help you approach financial decisions with greater clarity and confidence.

Developing Healthy Financial Habits

Consistent habits are key to long-term financial stability, and a life coach can guide you in developing these behaviors. Whether it’s building a savings plan, tracking expenses, or learning to live within your means, a life coach helps you implement daily practices that reduce stress. Over time, these habits will give you greater control over your financial situation, helping to ease anxiety and prevent future money-related concerns.

Building Emotional Resilience

Financial anxiety is often tied to how we emotionally respond to setbacks, like an unexpected bill or a job loss. A life coach works with you to build emotional resilience, teaching techniques such as mindfulness, meditation, or journaling to help you cope with stress. This emotional resilience allows you to face financial challenges with a calm, balanced approach, rather than spiraling into panic or fear.

Encouraging Accountability and Support

Sometimes, simply having someone to talk to can make a world of difference. A life coach provides a supportive, non-judgmental space where you can discuss your financial worries openly. They offer accountability, helping you stay on track with your financial goals, and providing encouragement when you feel discouraged. This partnership helps reduce feelings of isolation, which often exacerbate financial anxiety.

Gaining Confidence in Financial Decision-Making

A major contributor to financial anxiety is the fear of making wrong decisions. A life coach can guide you in becoming more confident with your choices by teaching decision-making strategies and encouraging you to trust your own judgment. With practice, you’ll learn to approach financial decisions with a clearer mind, reducing the fear and uncertainty that often accompany them.

Quiz: What Is Blocking Your Success?

This quick quiz will help you figure out which mental or behavioral pattern might be holding you back from achieving your full potential. Identifying your specific success blocker is the first step toward breaking through to new levels of achievement and fulfillment.

Read each question and choose the answer that feels most true to your situation.

No email or payment is required to complete the quiz and receive your personalized insights.

Once you have your primary success blocker, you have clarity about what’s been holding you back. This awareness is powerful—many people spend years struggling without understanding the specific pattern that’s limiting their progress.

Remember, these patterns aren’t permanent character traits but rather habitual ways of thinking and behaving that can be changed with the right guidance and practice.

If you’re ready to break through your specific blocker and achieve the success you know you’re capable of, send me an email to try out a coaching session. Your breakthrough awaits!

Conclusion

Financial anxiety can be paralyzing, but it doesn’t have to control your life. A life coach can help you gain a better understanding of your financial stressors, develop healthy habits, and shift your mindset toward a more balanced and peaceful relationship with money. By focusing on emotional well-being alongside financial goals, a life coach helps you build the confidence and resilience needed to overcome financial anxiety and live a more fulfilled, stress-free life.

Still waiting for the 'perfect time'?

Email me what you'd do if you stopped making excuses. We'll work backwards from there.

Let's startRecent posts

-

The Complete Guide to Becoming a High Achiever

Read blog -

How To Make a Positive Impact in Your Community

Read blog -

What Is the “Winter Arc” Challenge?

Read blog -

What Is "the Great Lock-In" and Should You Try It?

Read blog -

What Are the 75 Hard and Soft Challenges?

Read blog -

How to Validate Yourself

Read blog

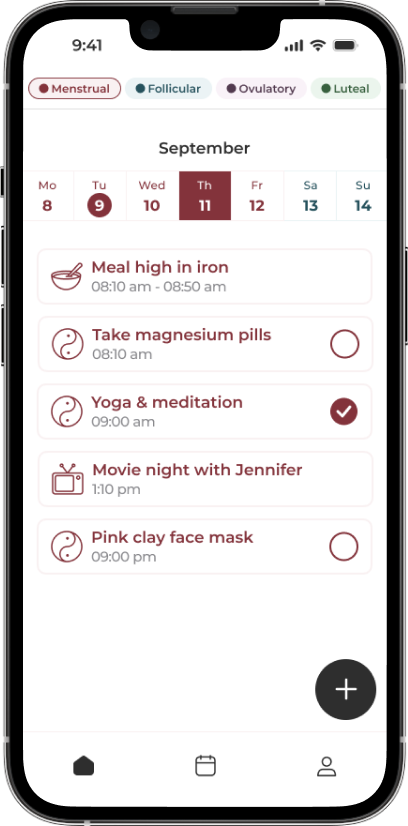

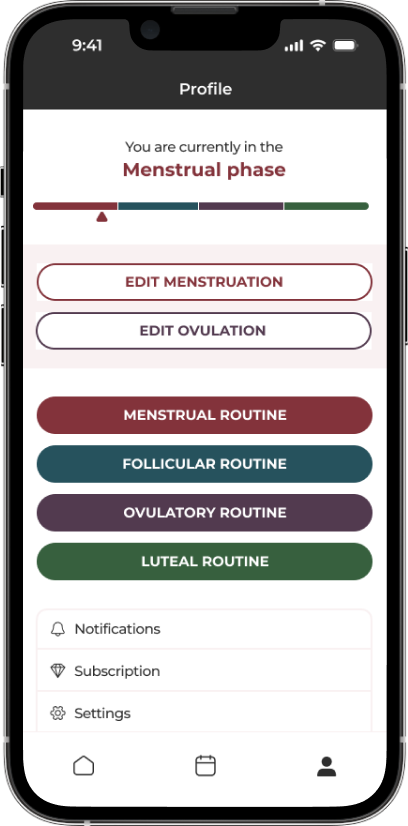

The App Made To Sync Your Lifestyle to Your Menstrual Cycle.

A solution for women who are looking to keep track of what they sync to their cycles, such as fitness, diet, etc. by adding it to a calendar that also predict their phases.

Learn more

Comment