How Can Life Coaching Improve My Financial Habits?

Developing strong financial habits is key to long-term financial stability and success, but it’s often easier said than done. Life coaching offers a unique approach to improving your financial habits by focusing not just on numbers but on your mindset, behaviors, and overall relationship with money. Here’s how life coaching can help you take control of your finances and develop habits that support your financial goals.

Understanding Your Financial Mindset

One of the first steps in improving your financial habits is understanding your current mindset around money. Many people have deep-rooted beliefs about finances, such as fear of scarcity, guilt over spending, or a reluctance to invest. A life coach helps you identify these beliefs and how they may be holding you back. By exploring your money mindset, you can begin to shift your perspective and approach finances with more clarity and confidence.

- Identify limiting beliefs and thought patterns about money.

- Understand how past experiences shape your financial habits.

- Explore emotional triggers that lead to overspending or avoidance.

Setting Clear and Attainable Financial Goals

Good financial habits start with having clear goals. A life coach helps you define what you truly want to achieve, whether it’s saving for a home, paying off debt, or simply gaining more control over your monthly spending. Unlike broad, vague goals, a coach helps you break them down into smaller, actionable steps that feel attainable. This clarity not only keeps you motivated but also ensures you’re building financial habits that align with your long-term vision.

- Define specific, measurable, and realistic financial goals.

- Break goals down into smaller, manageable steps.

- Create a timeline for achieving short-term and long-term objectives.

Creating a Personalized Financial Plan

While financial advisors may focus strictly on numbers, a life coach helps you build a financial plan tailored to your lifestyle and personality. This holistic approach takes into account your emotional triggers, your habits, and your daily routine. By understanding how you live and what drives your spending or saving behaviors, a life coach can help you create a plan that feels realistic and sustainable for the long term.

- Develop a financial plan that aligns with your lifestyle and goals.

- Consider your emotional responses to spending, saving, and budgeting.

- Create a flexible plan that can adapt as your financial situation changes.

Check out the Vision to Action Planner for only 6$

More infoDeveloping Consistent Money-Management Habits

Building better financial habits is all about consistency. Whether it’s budgeting, saving, or tracking expenses, a life coach can guide you in establishing daily or weekly routines that support your financial goals. This might involve setting aside time to review your finances, automating savings, or creating spending limits for specific categories. Over time, these small changes can become second nature, helping you stay on track without feeling overwhelmed.

- Establish regular habits like reviewing your budget weekly or monthly.

- Automate savings to ensure you’re consistently building your financial cushion.

- Set clear spending limits to prevent impulse purchases.

Overcoming Procrastination and Fear

Procrastination and fear are common barriers when it comes to managing finances. Many people avoid looking at their bank accounts, delay paying bills, or put off saving for the future out of fear or discomfort. A life coach helps you confront these obstacles head-on by identifying the emotions that cause procrastination and offering strategies to move past them. With regular support, you’ll feel more confident taking control of your financial life and addressing issues as they arise.

- Address the emotions that lead to procrastination in financial tasks.

- Learn techniques to manage financial fears, such as mindfulness or reframing.

- Build confidence to take timely action on financial decisions.

Building Financial Confidence

A lack of confidence often prevents people from making sound financial decisions, whether it’s hesitating to invest or feeling unsure about how to budget effectively. Life coaching works on boosting your financial self-confidence by equipping you with tools and knowledge. You’ll learn how to make informed decisions that align with your goals, leading to improved financial habits and a more secure financial future.

- Learn decision-making strategies to improve your financial choices.

- Gain tools to assess risks and rewards confidently.

- Increase self-assurance in budgeting, saving, and investing decisions.

Accountability and Progress Tracking

One of the most valuable aspects of life coaching is accountability. Your coach acts as a partner in your financial journey, keeping you on track and helping you stay focused on your goals. Regular check-ins ensure that you’re following through with the habits you’ve committed to, and if you slip up, a coach will help you course-correct without judgment. This support system makes it easier to maintain your financial habits long-term and track your progress along the way.

- Receive regular check-ins to assess your financial progress.

- Stay accountable to your goals through coaching feedback.

- Adjust your habits as needed to stay on track.

Reducing Financial Stress

Bad financial habits often lead to stress, whether it’s overspending, missing payments, or feeling out of control with your money. A life coach helps you reduce this stress by teaching you practical, mindful approaches to managing your finances. Through techniques such as journaling, visualization, or creating a spending plan that feels achievable, you’ll be able to handle your money with less anxiety and more peace of mind.

- Use mindful practices like journaling to reduce financial stress.

- Create a manageable spending plan to avoid financial overwhelm.

- Learn stress-management techniques to cope with money-related anxiety.

Conclusion

Improving your financial habits is more than just sticking to a budget—it’s about changing your mindset, behaviors, and approach to money. Life coaching offers personalized support and guidance to help you understand your financial habits, set realistic goals, and create routines that stick. With the help of a life coach, you can transform your relationship with money and build lasting financial habits that set you up for long-term success.

Quiz: What Is Blocking Your Success?

This quick quiz will help you figure out which mental or behavioral pattern might be holding you back from achieving your full potential. Identifying your specific success blocker is the first step toward breaking through to new levels of achievement and fulfillment.

Read each question and choose the answer that feels most true to your situation.

No email or payment is required to complete the quiz and receive your personalized insights.

Once you have your primary success blocker, you have clarity about what’s been holding you back. This awareness is powerful—many people spend years struggling without understanding the specific pattern that’s limiting their progress.

Remember, these patterns aren’t permanent character traits but rather habitual ways of thinking and behaving that can be changed with the right guidance and practice.

If you’re ready to break through your specific blocker and achieve the success you know you’re capable of, send me an email to try out a coaching session. Your breakthrough awaits!

Still waiting for the 'perfect time'?

Email me what you'd do if you stopped making excuses. We'll work backwards from there.

Let's startRecent posts

-

The Complete Guide to Becoming a High Achiever

Read blog -

How To Make a Positive Impact in Your Community

Read blog -

What Is the “Winter Arc” Challenge?

Read blog -

What Is "the Great Lock-In" and Should You Try It?

Read blog -

What Are the 75 Hard and Soft Challenges?

Read blog -

How to Validate Yourself

Read blog

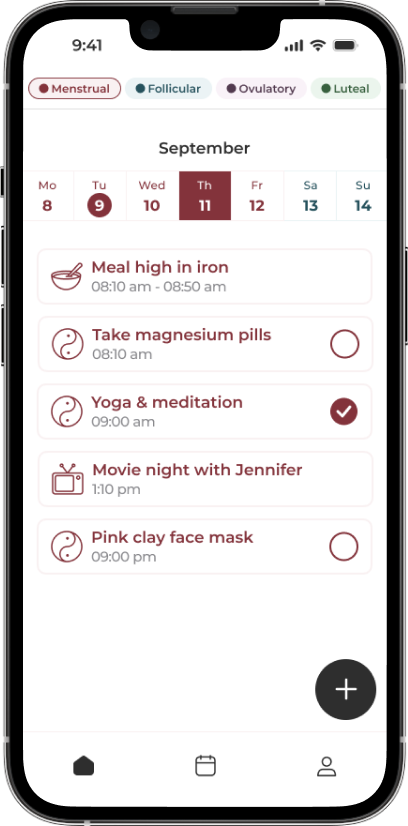

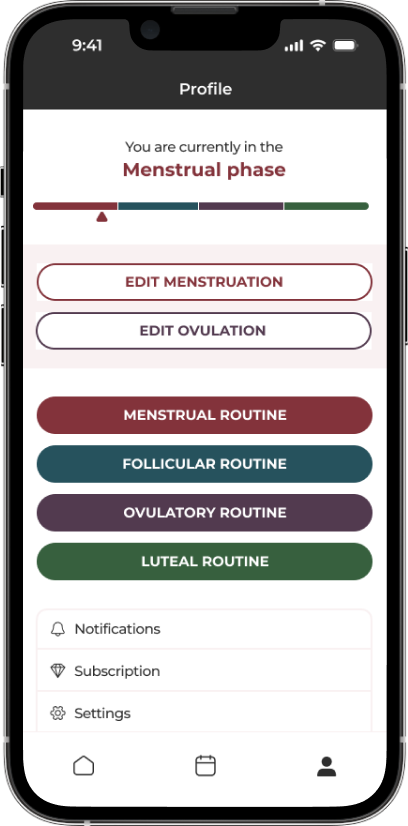

The App Made To Sync Your Lifestyle to Your Menstrual Cycle.

A solution for women who are looking to keep track of what they sync to their cycles, such as fitness, diet, etc. by adding it to a calendar that also predict their phases.

Learn more

Comment