What Is a Finance Coach?

A finance coach is a professional who specializes in guiding individuals and families to improve their financial health and achieve their monetary goals. They provide personalized advice and strategies to help clients understand and manage their finances effectively. Unlike traditional financial advisors, who may focus primarily on investments and asset management, finance coaches take a more holistic approach to personal finance, including budgeting, debt management, savings strategies, and financial literacy.

What Issues Does a Finance Coach Help With?

Finance coaches can assist clients with a variety of financial challenges, including:

- Budgeting Difficulties: Struggling to create or stick to a budget that aligns with financial goals.

- Debt Management: Feeling overwhelmed by debt and unsure how to develop a plan to pay it off.

- Saving for Goals: Difficulty in saving for specific goals, such as buying a home, funding education, or planning for retirement.

- Financial Literacy: Lack of understanding of financial concepts, such as interest rates, credit scores, and investment options.

- Spending Habits: Poor spending habits leading to financial strain or a lack of savings.

- Financial Anxiety: Stress or anxiety related to money management and financial future.

- Career Transitions: Needing guidance on how to manage finances during job changes, such as layoffs or career shifts.

These issues can create significant stress and hinder overall financial well-being, making it essential to seek support from a finance coach.

The Coaching Process

The coaching process typically begins with an initial consultation, where the coach assesses the client’s financial situation. During this session, the coach gathers information about the client’s income, expenses, debts, savings, and financial goals.

Once the assessment is complete, the coach collaborates with the client to develop a personalized financial plan. This plan outlines specific goals, action steps, and timelines for achieving those goals.

Throughout the coaching relationship, the coach provides ongoing support, accountability, and encouragement. Regular check-ins allow clients to discuss progress, address challenges, and make adjustments to their plans as needed.

Quiz: What Is Blocking Your Success?

This quick quiz will help you figure out which mental or behavioral pattern might be holding you back from achieving your full potential. Identifying your specific success blocker is the first step toward breaking through to new levels of achievement and fulfillment.

Read each question and choose the answer that feels most true to your situation.

No email or payment is required to complete the quiz and receive your personalized insights.

Once you have your primary success blocker, you have clarity about what’s been holding you back. This awareness is powerful—many people spend years struggling without understanding the specific pattern that’s limiting their progress.

Remember, these patterns aren’t permanent character traits but rather habitual ways of thinking and behaving that can be changed with the right guidance and practice.

If you’re ready to break through your specific blocker and achieve the success you know you’re capable of, send me an email to try out a coaching session. Your breakthrough awaits!

Techniques Used by Finance Coaches

Finance coaches employ a variety of techniques to help clients improve their financial situations, including:

- Budgeting Tools: Teaching clients how to create and manage budgets using tools and apps that simplify the process.

- Debt Reduction Strategies: Offering guidance on how to prioritize debt repayment and create a sustainable plan to eliminate debt.

- Savings Plans: Assisting clients in setting up savings goals and automating savings to make it easier to reach targets.

- Financial Education: Providing resources and education on key financial topics to improve clients’ financial literacy.

- Accountability Systems: Implementing accountability measures, such as regular check-ins, to keep clients motivated and on track.

- Goal Setting: Helping clients establish clear, measurable financial goals that align with their values and aspirations.

These techniques empower clients to take control of their finances and make informed decisions.

What Improvements to Expect

Working with a finance coach can lead to significant improvements in various aspects of a client’s financial life. Some of the improvements clients can expect include:

- Enhanced Financial Knowledge: Clients will gain a deeper understanding of financial concepts and practices, allowing them to make informed decisions.

- Improved Budgeting Skills: Clients will develop effective budgeting skills, leading to better money management and reduced financial stress.

- Debt Reduction: Clients will learn strategies to manage and pay down debt, resulting in improved financial stability.

- Increased Savings: Clients will be better equipped to save for their goals, leading to greater financial security.

- Reduced Financial Anxiety: As clients gain control over their finances, they often experience reduced stress and anxiety related to money matters.

The Benefits of Finance Coaching

Finance coaching offers numerous benefits, including:

- Personalized Support: Clients receive tailored advice and strategies that address their unique financial situations and goals.

- Skill Development: Clients enhance their financial skills, leading to improved money management and decision-making.

- Accountability: The coach provides accountability, helping clients stay committed to their financial goals and action plans.

- Increased Confidence: Clients gain confidence in their financial abilities, empowering them to make informed decisions and take action.

- Long-Term Success: Clients leave the coaching relationship with the tools and knowledge needed to sustain their financial health long after the coaching has ended.

Finance coaching can benefit individuals at any stage of their financial journey, whether they are just starting to manage their finances or seeking to optimize their existing financial strategies. The skills and knowledge gained through finance coaching can have a lasting impact on a client’s financial well-being and overall quality of life.

In conclusion, a finance coach serves as a valuable resource for anyone looking to improve their financial health and achieve their goals. By providing personalized guidance, support, and accountability, finance coaches empower clients to take control of their financial futures and make informed decisions that lead to lasting success.

Looking for a Finance Coach?

Feeling stuck, overwhelmed, or uncertain about your next steps? As an experienced life and finance coach, I specialize in helping individuals create a future that feels fulfilling and aligned with their goals. Reach out today to start creating the future you deserve.

Still waiting for the 'perfect time'?

Email me what you'd do if you stopped making excuses. We'll work backwards from there.

Let's startRecent posts

-

The Complete Guide to Becoming a High Achiever

Read blog -

How To Make a Positive Impact in Your Community

Read blog -

What Is the “Winter Arc” Challenge?

Read blog -

What Is "the Great Lock-In" and Should You Try It?

Read blog -

What Are the 75 Hard and Soft Challenges?

Read blog -

How to Validate Yourself

Read blog

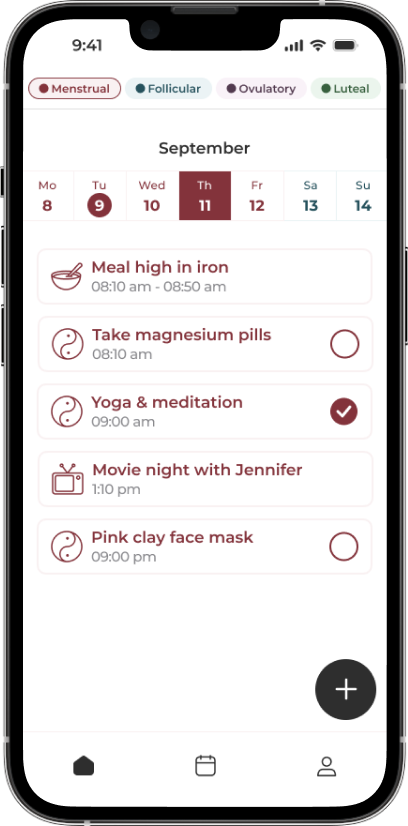

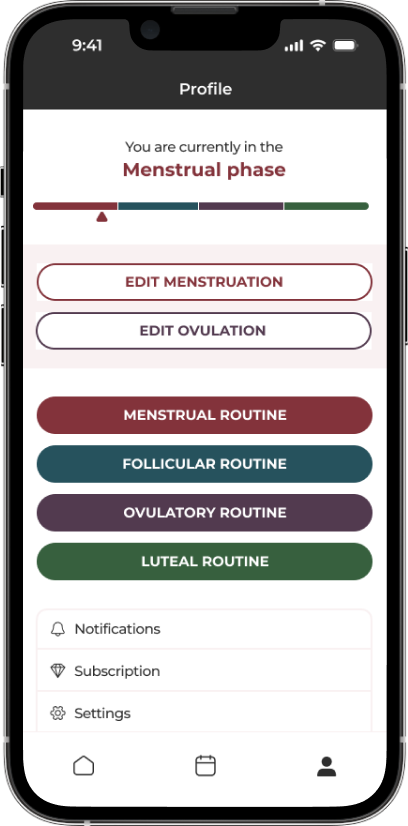

The App Made To Sync Your Lifestyle to Your Menstrual Cycle.

A solution for women who are looking to keep track of what they sync to their cycles, such as fitness, diet, etc. by adding it to a calendar that also predict their phases.

Learn more

Comment