What Strategies Do Life Coaches Use for Managing Personal Finances?

Life coaches provide personalized support to help you manage your finances by addressing both the emotional and practical aspects of money. They guide you through specific strategies that fit your financial situation, goals, and personality. Here are some of the most effective strategies life coaches use and how they can help you implement each one.

Zero-Based Budgeting

How it works: Zero-based budgeting requires you to allocate every euro (or dollar) of your income to a specific purpose, so your income minus your expenses equals zero. This means assigning money to savings, debt repayment, and even discretionary spending until your budget is fully accounted for.

Who it works for: This strategy is ideal for people who need structure and want to ensure every cent is put to use. It’s especially effective for those looking to cut down on unnecessary expenses and gain tighter control over their spending. It also works well for freelancers or people with fluctuating incomes.

How a life coach helps: A life coach will help you create and stick to a zero-based budget by walking you through your income and expenses. They’ll guide you in making conscious spending decisions and help you find the right balance between essential expenses, debt repayment, and savings. The coach will also hold you accountable to your budget, ensuring you adjust as your circumstances change.

The 50/30/20 Rule

How it works: The 50/30/20 rule is a simpler budgeting strategy where you allocate 50% of your income to needs (rent, bills, groceries), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. It’s a flexible guide rather than a rigid system.

Who it works for: This strategy works best for people who prefer a balance between financial discipline and spending flexibility. If you want an easy-to-follow structure without having to track every small expense, this rule provides a manageable framework while allowing room for discretionary spending.

How a life coach helps: A life coach will help you break down your income into these three categories, identifying which expenses fit into each. They’ll offer advice on how to stick to your 30% of “wants” without feeling deprived, and they’ll ensure you’re allocating enough to savings and debt repayment. Your coach can also help you tweak these percentages if your financial situation changes.

Check out the Vision to Action Planner for only 6$

More infoQuiz: What Is Blocking Your Success?

This quick quiz will help you figure out which mental or behavioral pattern might be holding you back from achieving your full potential. Identifying your specific success blocker is the first step toward breaking through to new levels of achievement and fulfillment.

Read each question and choose the answer that feels most true to your situation.

No email or payment is required to complete the quiz and receive your personalized insights.

Once you have your primary success blocker, you have clarity about what’s been holding you back. This awareness is powerful—many people spend years struggling without understanding the specific pattern that’s limiting their progress.

Remember, these patterns aren’t permanent character traits but rather habitual ways of thinking and behaving that can be changed with the right guidance and practice.

If you’re ready to break through your specific blocker and achieve the success you know you’re capable of, send me an email to try out a coaching session. Your breakthrough awaits!

The Envelope System

How it works: In the envelope system, you allocate cash to different spending categories and place it in physical envelopes (or virtual envelopes through apps). Once an envelope is empty, you can’t spend more in that category until the next month.

Who it works for: This method works well for individuals who struggle with overspending and need a visual, tactile way to control their expenses. It’s particularly effective for people who want to limit spending in specific categories, like dining out or entertainment.

How a life coach helps: A life coach will guide you in setting up the envelope system and determining how much to allocate to each category. They’ll also help you identify any spending patterns and give you strategies for sticking to the system, even when it’s challenging. Your coach will regularly check in with you to ensure the system is working and make adjustments if needed.

The Debt Snowball Method

How it works: The debt snowball method focuses on paying off your smallest debt first while making minimum payments on other debts. Once the smallest debt is paid off, you move on to the next smallest, gaining momentum and motivation with each debt cleared.

Who it works for: This strategy is ideal for individuals who need quick wins to stay motivated. If you’re someone who thrives on seeing immediate progress and likes celebrating small victories, the debt snowball method can provide the encouragement needed to continue paying off debts.

How a life coach helps: A life coach will help you list and prioritize your debts, focusing on paying off the smallest balance first. They’ll keep you motivated and help you celebrate each debt paid off, keeping you on track. They’ll also ensure you maintain focus on the bigger financial picture as you tackle each debt.

The Debt Avalanche Method

How it works: The debt avalanche method focuses on paying off debts with the highest interest rates first, while continuing to make minimum payments on other debts. This saves more money in the long run by reducing the amount of interest paid over time.

Who it works for: This approach works well for people who are more focused on long-term financial benefits rather than immediate satisfaction. It’s best suited for those who prioritize minimizing the overall cost of debt repayment.

How a life coach helps: Your life coach will assist in organizing your debts by interest rate and guide you through paying off high-interest debts first. They’ll help you stay patient and persistent, reminding you of the financial savings you’ll gain in the long run. The coach can also provide encouragement if you feel discouraged by the slower progress in the beginning.

SMART Financial Goal Setting

How it works: SMART goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Life coaches use this framework to help clients create clear financial goals. For example, instead of a vague goal like “save more money,” a SMART goal would be “save €1,000 for an emergency fund in six months by setting aside €167 per month.”

Who it works for: This strategy is great for people who feel overwhelmed by their financial goals or don’t know where to start. If you’re someone who needs structure and clarity to make progress, SMART goal setting offers a clear path forward.

How a life coach helps: A life coach will work with you to turn your financial aspirations into SMART goals. They’ll help you break down large, intimidating financial goals into smaller, manageable steps. Your coach will also track your progress, making sure your goals are realistic and achievable within your timeframe.

The Pay Yourself First Method

How it works: This strategy involves prioritizing savings or investments before paying any other expenses. You set aside a fixed amount or percentage of your income for savings as soon as you get paid, treating it like a non-negotiable bill.

Who it works for: The “pay yourself first” method is effective for individuals who struggle to save because they tend to spend their paycheck on other things first. It’s especially beneficial for those who want to build savings consistently.

How a life coach helps: A life coach will help you determine how much you should save and ensure that saving becomes a priority, not an afterthought. They’ll also provide support by helping you resist the temptation to dip into your savings for non-essential purchases. Your coach will hold you accountable to these savings goals each month.

Creating Spending Triggers

How it works: Life coaches use spending triggers to help clients become more mindful of their spending habits. Triggers can be cues like writing down a reason for every purchase over a certain amount or setting reminders before making non-essential purchases.

Who it works for: This strategy works well for people who struggle with impulsive spending or emotional purchases. If you’re someone who tends to buy things on a whim or as a reaction to stress, spending triggers can help you pause and reconsider those decisions.

How a life coach helps: A life coach will help you identify your specific spending triggers and create systems to manage them. They’ll provide alternative actions when you feel the urge to spend impulsively, such as pausing for a few minutes or finding a non-financial way to cope with emotions like stress or boredom. Regular sessions with your coach will help reinforce these new habits.

The 24-Hour Rule

How it works: The 24-hour rule is a simple practice where you wait 24 hours before making any significant or non-essential purchases. This cooling-off period gives you time to reflect on whether the purchase aligns with your financial goals.

Who it works for: This method is excellent for individuals who have difficulty resisting impulse buys. If you find yourself often regretting purchases or overspending, this rule can help curb those habits.

How a life coach helps: A life coach will encourage you to implement the 24-hour rule and remind you of the importance of aligning your spending with your long-term financial goals. They’ll check in to see how the rule is working and suggest tweaks if necessary. Over time, your coach will help you build the discipline to delay gratification and prioritize meaningful purchases.

Financial Accountability Partnerships

How it works: Life coaches often encourage clients to partner with a friend, family member, or even the coach themselves to create an accountability system. This means checking in with someone regularly about your progress, financial challenges, and victories.

Who it works for: Accountability partnerships are ideal for those who struggle to stay disciplined on their own or lose motivation over time. If you’re someone who needs external support and encouragement to stick to your financial goals, this strategy ensures you stay on track.

How a life coach helps: Your life coach will act as an accountability partner, checking in regularly to discuss your financial progress. They’ll provide constructive feedback, encouragement, and a non-judgmental space for discussing financial challenges. By having a coach to report to, you’re more likely to stay committed to your goals.

Conclusion

Life coaches use a variety of strategies to help individuals manage their personal finances, from budgeting techniques to debt repayment plans and accountability systems. Whether you need a structured approach or emotional support, a life coach can tailor these strategies to your unique financial situation and personality, ensuring long-term success in managing your money.

Still waiting for the 'perfect time'?

Email me what you'd do if you stopped making excuses. We'll work backwards from there.

Let's startRecent posts

-

The Complete Guide to Becoming a High Achiever

Read blog -

How To Make a Positive Impact in Your Community

Read blog -

What Is the “Winter Arc” Challenge?

Read blog -

What Is "the Great Lock-In" and Should You Try It?

Read blog -

What Are the 75 Hard and Soft Challenges?

Read blog -

How to Validate Yourself

Read blog

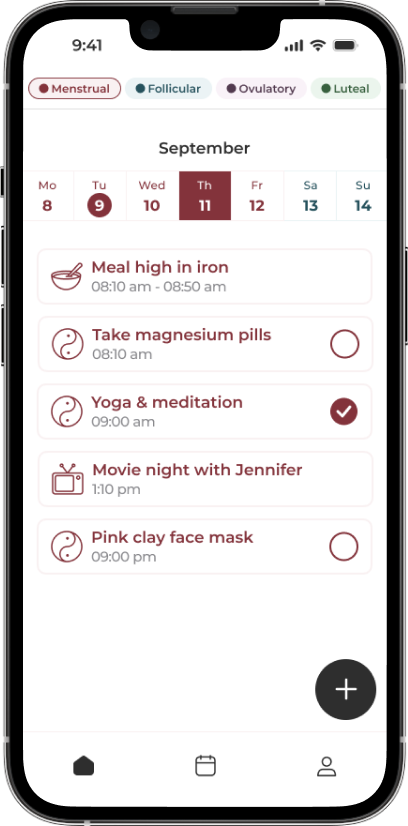

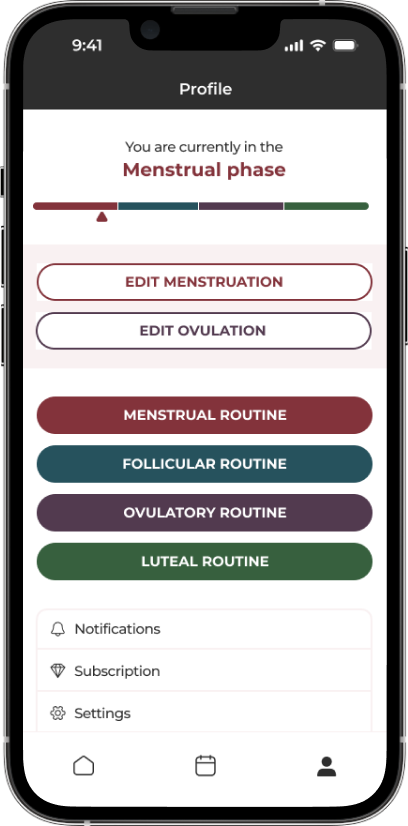

The App Made To Sync Your Lifestyle to Your Menstrual Cycle.

A solution for women who are looking to keep track of what they sync to their cycles, such as fitness, diet, etc. by adding it to a calendar that also predict their phases.

Learn more

Comment